Published on 16.08.2021

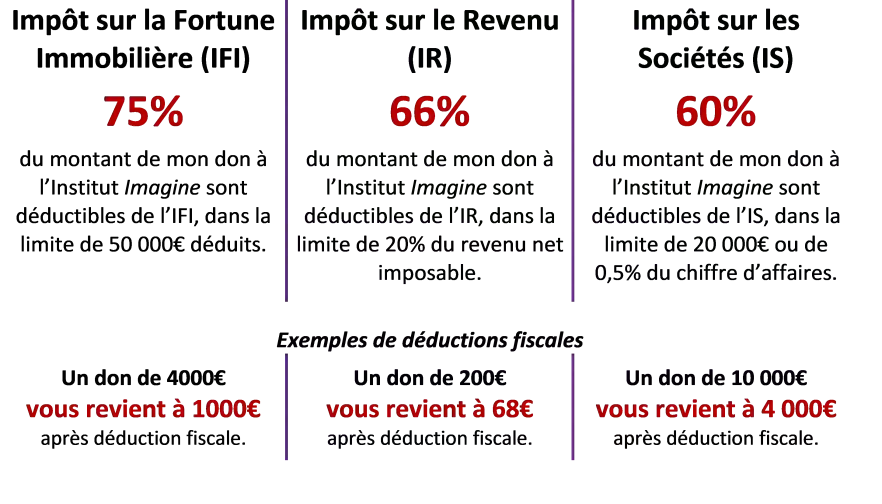

French tax laws allow you to deduct a percentage of your donation from your taxes.

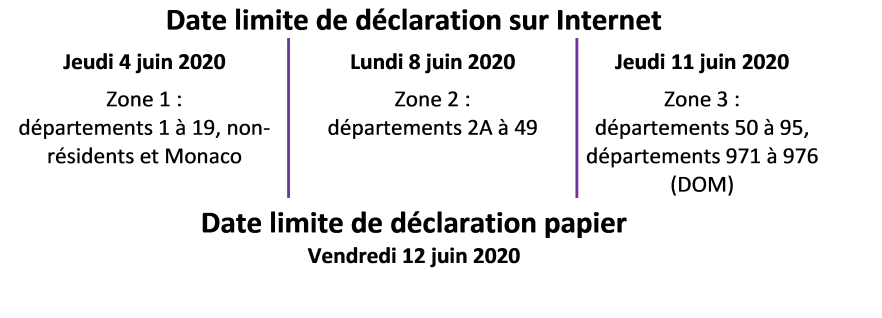

Due to the exceptional context related to COVID-19 in France, the government has taken the decision to set a new tax calendar and to postpone the deadline for the tax return.

As a reminder, your tax receipt is not necessary to complete your tax return. It will only be requested in case of a tax audit.

IFI FOCUS

- Within the framework of the IFI, these deadlines are also applicable to tax exemption operations. Thus, in order to benefit from this tax, you must make your donation before the deadline of your declaration.

- The tax on real estate wealth (IFI) concerns tax households whose real estate assets not used for professional activities exceed €1,300,000 on 01/01/2020.

- Only real estate assets are taken into account in the base of this new tax (all property and real estate rights belonging to the taxpayer, including the principal residence which retains a 30% allowance).

- The scale of the 2020 IFI remains identical to that of 2019 (on 6 progressive brackets). The discount mechanism of the former ISF, applicable to assets between 1.3 and 1.4 million euros, is retained.

- Unlike the ISF, the deadline for filing the tax return no longer depends on the amount of taxable assets: regardless of the value of your assets, your IFI tax return must be filed at the same time and within the same timeframe as your income tax return.